We know the significance of 2 haggles wheels Insurance so we bring this significant Gujarati instructional exercise. The proprietor of a safeguarded vehicle is the main party, a safety net provider is the subsequent party and the individual engaged with a mishap with the protected vehicle is outsider. Each four-wheeler proprietor/first-party lawfully need an outsider vehicle protection spread to drive on the Indian streets.

You can reestablish outsider risk vehicle protection through the sites of most insurance agencies. On the off chance that this office isn’t offered by your insurance agency, you can go to the safety net provider’s branch office and solicitation for an arrangement recharging.

The snappiest method to check if your vehicle’s protected is to run its number plate through the Motor Insurer’s Database (MID). This free search will reveal to you whether the vehicle is guaranteed and will affirm the make and model. Be that as it may, on the off chance that you need to discover the guarantor’s name or some other arrangement subtleties, you’ll need to pay £4.

The main party is you, the guaranteed. The subsequent part is the insurance agency. The outsider is any other person taking an interest in the case. The outsider could have experienced property harm or has individual damage as a result of something that the protected did or is blamed for doing.

Business accident protection cost fluctuates broadly relying upon various variables, including the number and sorts of vehicles your business employments. Strategies for one vehicle ordinarily cost not as much as arrangements for an armada of trucks. Be that as it may, most entrepreneurs can hope to pay $750 to $1,200 per vehicle in yearly premium.

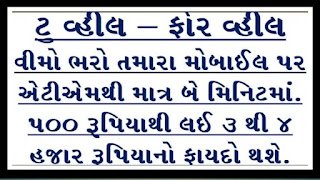

⏭️ Click Here Read Details In Gujarati